Health Savings Account

Don’t let the name be confusing. Our Health Savings Account is a checking account designed to meet the needs of eligible individuals who participate in a high deductible health plan as defined by the Internal Revenue Service. Consult your tax advisor if you are not certain you qualify for an HSA.

Key features include:

- No minimum monthly balance requirements, no monthly service charge, and no transactions fees.

- The minimum opening deposit is $25.00.

- We use the daily balance method to calculate interest on your account. Interest is compounded daily and credited to your account monthly.

- The interest rate and annual percentage yield for your account are determined and paid by tier depending upon your account balance, allowing you to earn more as your balance grows.

Tiers

Rates effective as of September 19, 2019 and subject to change without notice.

| Greater Than | but less than | Interest Rate | APY |

|---|---|---|---|

| $0.00 | $2,500.01 | 0.05% | 0.05% |

| $2,500.00 | $5,000.01 | 0.10% | 0.10% |

| $5,000.00 | $10,000.01 | 1.50% | 1.51% |

| $10,000.00 | $17,500.01 | 1.75% | 1.77% |

| $17,500.00 | $25,000.01 | 2.00% | 2.02% |

| $25,000.00 | No Limit | 3.50% | 3.56% |

Our HSA is modestly priced and offers tremendous value. It is very important that you understand the fees that may apply, as well as the things you can do to avoid them.

Summary of HSA Fees

| Description | Amount | What You Can Do to Avoid Fee |

|---|---|---|

| Monthly Maintenance | $0.00 | There is no monthly minimum balance requirement to avoid a fee. |

| Debit Card | $0.00 | There is no fee to have a debit card. |

| Point of Sale Debit Purchase | $0.00 | Both PIN and signature POS transactions are free. |

| Recurring Debit Card Purchase | $0.00 | There is no fee for debit card purchases. |

| Returned Deposited Item | $0.00 | There is no fee for Returned Deposited Items. |

| Online Banking | $0.00 | There is no fee to enroll in Online Banking. |

| Check Order* | $15.00 | Use your debit card for purchases and Online Banking for transfers between accounts. |

| Foreign ATM Fee** | $1.00 | Use one of our ATMs. |

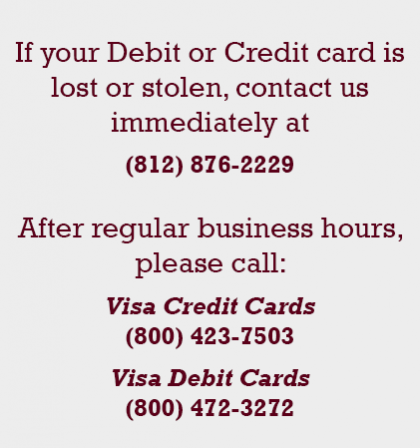

| Replace Lost/Stolen Debit Card | $2.50 | Protect your debit card as you would cash. |

| Research Fees | $15/hr & $1/page | View, save, or print copies of statements using Online Banking. |

| Reprinted Statements | $3.00 | View, save, or print copies of statements using Online Banking. |

| Stop Payment Fee | $30.00 | Only incurred if you request The Peoples State Bank to Stop Payment on a check or electronic transaction. |

| Non-Sufficient Funds (NSF) Fee Per Item | $30.00 | Use Online Banking to check your balance and track your transactions. |

| Overdraft Fee Per Item*** | $30.00 | Use Online Banking to check your balance and track your transactions. |

| Overdrawn Account Fee | $5.00/day | Deposit to cover overdraft within 5 days. |

| Dormant Account | $3/month | Conduct account activity at least once every 3 years. |

*Standard check. Other styles available; prices vary.

**In addition to our fee, the owner of the ATM may assess a surcharge.

***You agree not to overdraw your HSA, as doing so may invalidate it under IRS rules. The Peoples State Bank will not intentionally approve everyday debit card transactions to create an overdraft. We use our best efforts to approve everyday debit card transactions based upon your available account balance at the time of the transaction. Should an everyday debit card transaction that we approve later result in an overdraft upon posting (for example, due to a payment system issue beyond our control or from an outstanding check that subsequently clears), we will not assess an overdraft fee for the everyday debit card transaction.